Midsize firms anticipate that making and receiving payments will become even more of a core necessity very soon. On average, firms expect a 50% increase in payments made and a 46% increase in invoices delivered in the next three years. Adding to the urgency, automating these processes can decide whether vendors or suppliers get paid on time or late and how quickly businesses collect receivables.

Midsize firms, those with annual revenues between $3.5 million and $15 million, prioritize instant money transfers, mobile payment systems and credit cards for payments through accounts payable (AP) systems. Meanwhile, 71% of firms favor instant money transfers, 63% prefer mobile payments and 51% prefer credit cards.

These are some findings from “Accounts Payable and Receivable Trends and the Path to Profitability,” a PYMNTS Intelligence and American Express collaboration. This report draws on a survey of 412 executives with day-to-day and strategic leadership responsibilities in accounts payable, accounts receivable and payments strategy conducted from June 9 to July 5. The study examines executives’ beliefs about automating AP and AR processes and midsized firms’ decisions to modernize their AP and AR systems as a safeguard during tough economic times.

Most midsize firms have embraced automating AP and AR processes. Also, most plan to increase their AP and AR automation in the next three years.

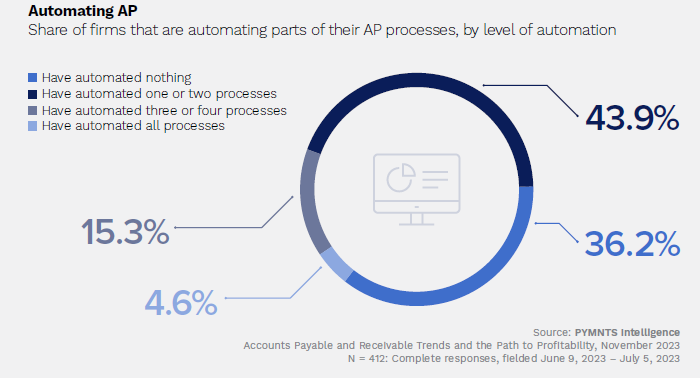

With AP and AR volumes expected to grow, business managers are evaluating whether their current solutions are enough. More than 60% of firms have already automated at least some AP and AR processes, and the push for automation continues. Approximately 3 in 10 firms are currently improving AP and AR automation capabilities. Roughly half plan to start within the next year.

Automation increases satisfaction with AP and AR systems and brings wide-ranging benefits to protect midsize firms against tough economic conditions.

Executives know the many benefits of automations. Eighty-five percent report AP automation leads to efficient, accurate or streamlined processes. Eighty-three percent report the same about AR automation. Those are not the only benefits: 73% reported that AP automation improves cash flow, increases savings or contributes to business growth. Seventy-five percent reported the same for AR automation. Firms that have held off on automation may lose out on key efficiencies.

Executives know the many benefits of automations. Eighty-five percent report AP automation leads to efficient, accurate or streamlined processes. Eighty-three percent report the same about AR automation. Those are not the only benefits: 73% reported that AP automation improves cash flow, increases savings or contributes to business growth. Seventy-five percent reported the same for AR automation. Firms that have held off on automation may lose out on key efficiencies.

Firms that automate most or all their processes see the greatest benefits.

Automating helps firms address a wide range of challenges, and those that do so for most or all processes see the greatest benefits. Nearly half of firms that have automated most or all processes reported experiencing no AR challenges. In contrast, just 8.8% of those that have automated just one or two AR processes say the same.

Despite the many advantages to automating AP and AR processes, more than one-third of businesses have held out. Download the report to learn more about how automating AP and AR processes can help firms chart a path to profitability.