Just_Super

Rising interest rates have hurt many long-duration areas of the stock market. With the 20-year Treasury yield climbing above 5% for a time this week, the cost of capital is simply much more expensive for growth firms. That also results in future cash flows being discounted more steeply. Unprofitable tech and small-cap growth names have been particularly battered since rates took off in mid-July.

I have a buy rating on The WisdomTree Cloud Computing Fund (NASDAQ:WCLD) for its more appealing valuation today, equal-weight construct, and emerging bullish setup both on the chart and with respect to seasonal trends.

Long-Term Treasuries & Long-Duration Cloud Stocks Suffer in August & September

Stockcharts.com

According to the issuer, the WisdomTree Cloud Computing ETF seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index, an equally weighted index designed to measure the performance of emerging public companies focused on delivering cloud-based software to customers.

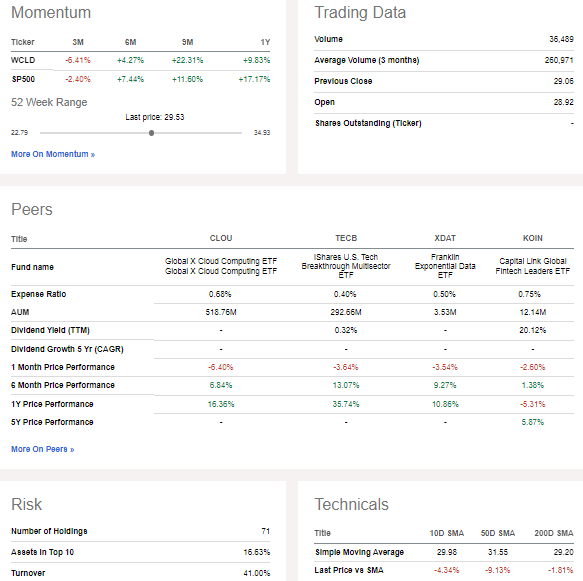

WCLD is not a large fund – total assets under management sum to $611 million, and the fund does not currently pay a dividend. With a 0.45% annual expense ratio, it is cheaper than many other small sector ETFs, and the 30-day average volume is low at just 171,500 shares as of September 27, 2023. Still, WCLD earns a solid B+ liquidity rating due, in part, to its low 30-day median bid/ask spread of six basis points.

Investors should be aware of high volatility and risk with the portfolio, however. The ETF’s 30.4% standard deviation is significantly higher than the market’s average and other industry ETFs. A bright spot on the risk front is seen in its allocation, as a low 17% of assets are in the top 10 holdings.

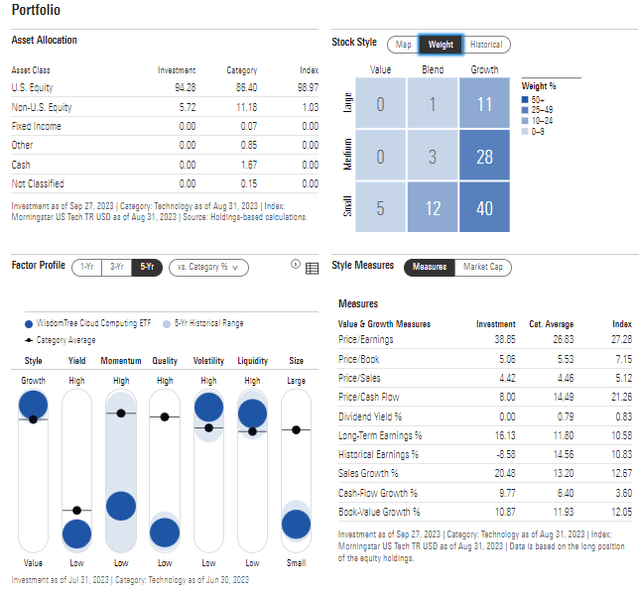

Digging into the portfolio, WCLD is very much a growth allocation. Just 5% of WCLD is considered value, and less than one-fifth of the fund is blend. The plurality of assets is considered small-cap growth per Morningstar. Momentum is currently very weak, while the earnings quality of the fund is relatively low from a factor perspective.

Value investors may scoff at WCLD’s current forward price-to-earnings ratio of 43.6 (per WisdomTree) but consider that the portfolio trades at 4.4 times sales with long-term earnings growth of more than 16% and sales growth of better than 20%. Given that the fund remains down more than 50% from its late 2021 peak, considerable bearish sentiment, including the reality of higher interest rates, has been discounted into the fund’s value, in my view.

WCLD: Portfolio & Factor Breakdown

Morningstar

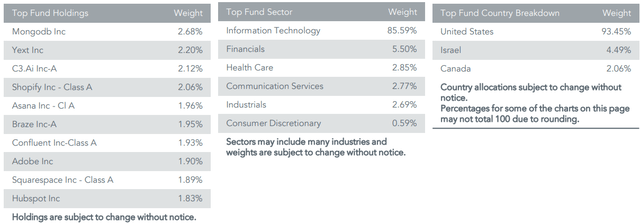

WCLD Fund Top Holdings, Top Fund Sectors, Top Fund Country Breakdowns

WisdomTree

WCLD: Trading Data & Peer Analysis

Seeking Alpha

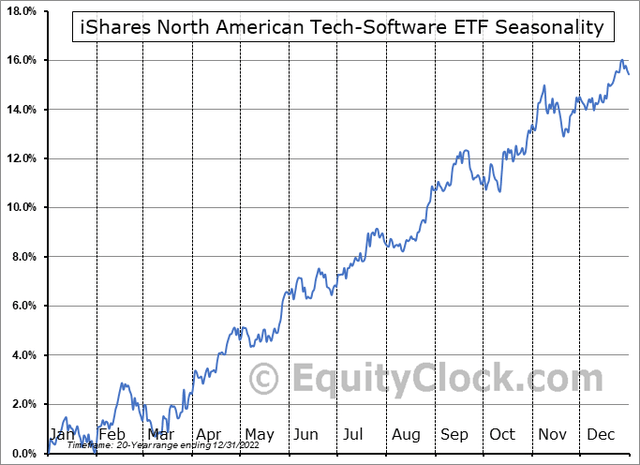

Seasonally, a late-September pullback is commonplace with a comparable tech ETF, according to data from Equity Clock. The below seasonal view of the iShares North America Tech-Software ETF (IGV) illustrates that the turn of the calendar from Q3 to Q4 is often a solid ‘buy the dip’ period, with enhanced gains through year-end before an early-year consolidation.

IGV: Risky Tech Stocks Often Rally in Q4

Equity Clock

The Technical Take

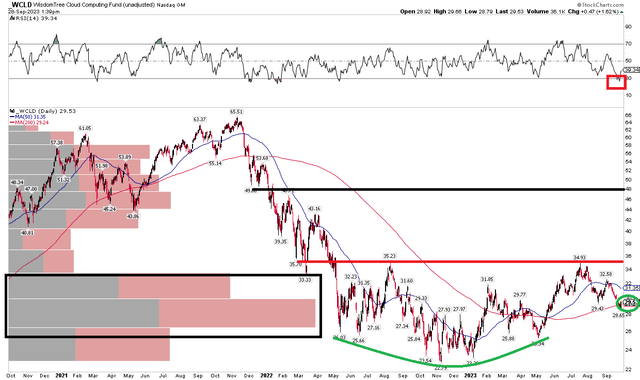

After a steep 64% bear market over the course of just 12 months, WCLD has been working on a bearish to bullish reversal. Notice in the chart below that a rounded bottom is in the works, but the bulls must still rally WCLD above the key $35 mark. That level was resistance in August last year and again this past July. With a near-term pullback perhaps finding some support at the rising 200-day moving average, and with bullish seasonality on the doorstep, I assert that now is an opportune time to get long shares.

Another thing to consider is that the 200dma is positively sloped after a protracted period of moving lower – another indicator of a trend reversal. With short-term RSI readings touching the lowest level since early 2022, the 10% giveback this month is potentially oversold. Finally, there’s high volume by price up to $33 which could give the bulls fits, so that is a key technical risk.

Overall, I see support near current levels, while $35 is resistance. A further layer of support may be found at the May low just above $25. Looking further out, if WCLD breaks out above $35, then a bullish measured move price objective to near $48 would be in play – based on the $13 rounded bottom pattern’s range added to the breakout point.

WCLD: Bearish to Bullish Reversal, $35 Resistance, Testing 200DMA Currently

Stockcharts.com

The Bottom Line

I have a buy rating on WCLD. The valuation is reasonable today, and technicals point to the $28 to $30 area being a solid risk/reward point to get long. Keep your eyes on $35 for a potential breakout later this year.