Amid an uncertain market with continued pressure to produce positive testing results and a steady downturn in venture capital funding, life sciences startups are being asked to do more with less. Companies offering robotics and automation technology and software to make labs more efficient see this as their moment.

Consulting firm Skyquest predicts a significant boom in investment in the space through 2030, when the global market for such technologies is expected to reach $10B, centered in North America and incorporating top tech and biotech firms such as Thermo Fisher and Roche.

The use of technology, especially automation and robotics, to speed up biotech, has been growing in the industry for years, and has led to a new generation of higher-tech labs. This technological evolution appears set to accelerate, raising questions about its potential to alter the real estate footprint of lab tenants and even potentially alter the demand for new lab space.

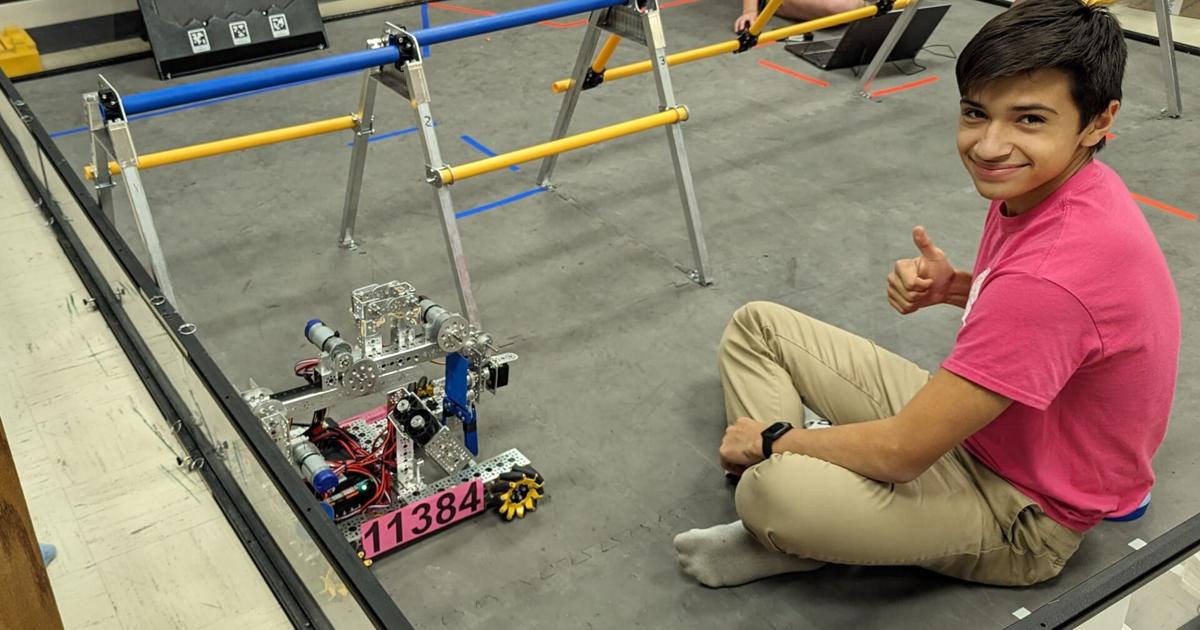

Startups hope automation and robotics can help make lab work more efficient.

“Outsourcing, robotization, miniaturization, all the same trends are impacting every business, even ours,” Lab Launch CEO Llewellyn Cox, a former scientist whose firm has developed a pair of incubation and postgraduate lab spaces in Los Angeles, told Bisnow. “Companies are looking for smaller spaces. Even five to 10 years ago, labs were less about people stirring beakers and mixing solutions than most people envision.”

Increased processing power, as well as more personalized cures promised by emerging cell and gene therapy, means the computational heft is available to test massive libraries of cells, biologics and cures through rote experimentation. At the same time, firms focused on achieving approval and testing milestones can also leverage machines and machine learning to more quickly replicate tests and test results, allowing them to prove out their cures and products more rapidly and with fewer errors. The testing and validation process for new cures costs roughly $2B on average.

Many large firms have already seen substantial benefits from utilizing artificial intelligence and automation in the lab. Moderna utilized AI to optimize mRNA sequencing, part of the research that enabled the creation of a coronavirus vaccine for testing in 42 days, per Randstad.

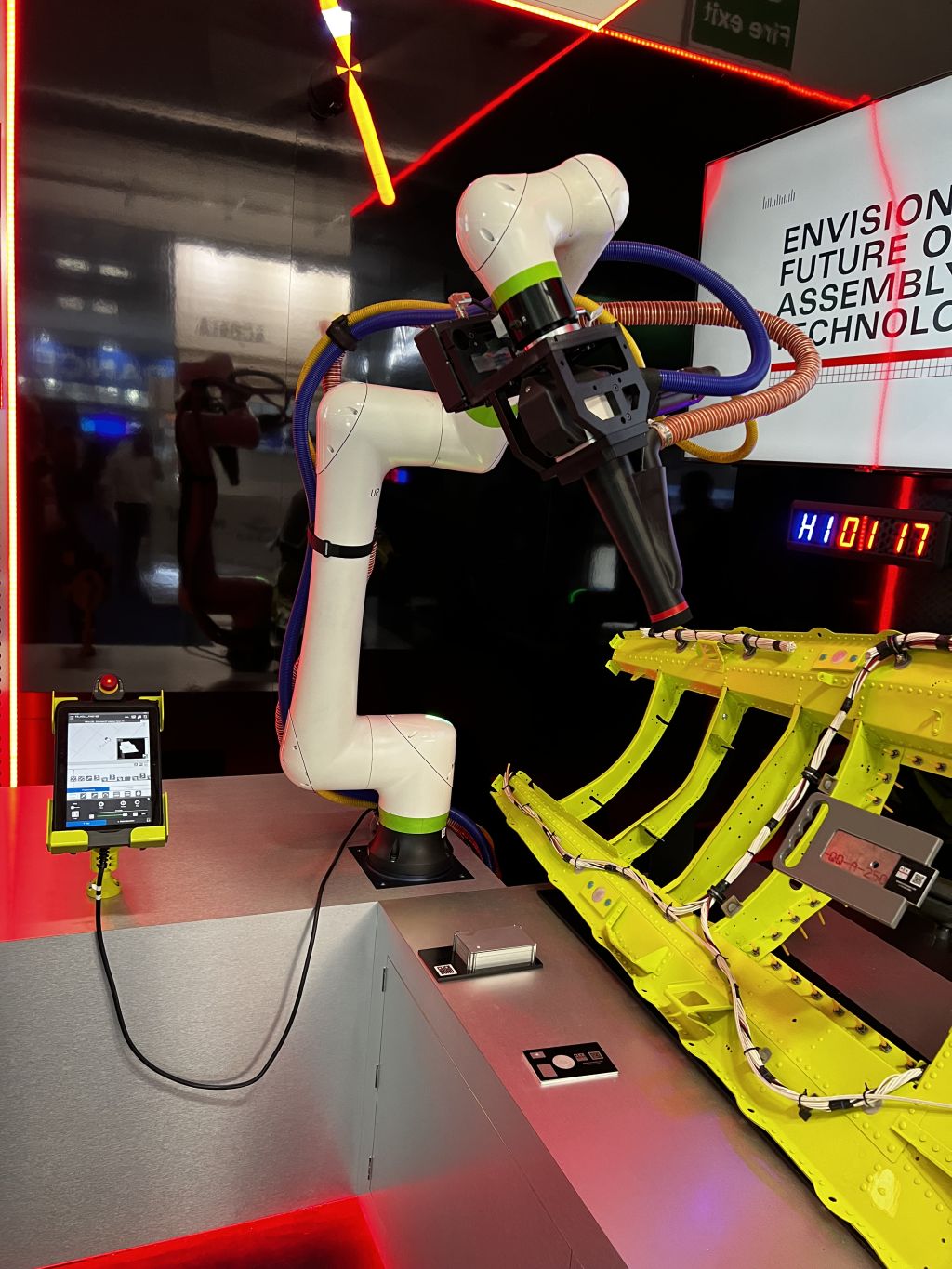

The National Institute for Innovation in Manufacturing Biopharmaceuticals, or NIIMBL, has been awarding million-dollar grants for years, seeking to speed up biomanufacturing and develop more accurate computer sensors to accelerate drug development and manufacturing. Merck has invested in robotic process automation. The Royal Marsden in the UK plans to install and utilize automated clinical genomic testing beginning in 2024, with plans to install six robots to rapidly speed up genetic screening service.

“There’s a huge need right across the country because labs tell us they don’t have the footprint or ability to hire enough skilled staff,” Nick Pattinson, vice president of product strategy for Automata, the firm behind the system, told Diginomica. “Plus, it really blew our minds how hard it is to find lab space at the moment, how precious every square meter is. But at the same time, they are being asked to increase their output massively.”

Other analysts, such as Ariel Gruswitz, a consultant at Facility Logix LLC, say they have yet to see this technology make a dent in space planning and that any shifts would take place years into the future.

At the same time, the life sciences real estate market has seen increased supply in recent months, with moderate demand leading to more rent concessions, decreasing some of the pressure to be more efficient with space. CBRE found the second quarter ended with a national lab vacancy rate of 9%, a jump from 6.7% in the previous quarter, with 40.8M SF of lab and research and development space under construction.

But advocates already see a future influenced by tech taking shape. Opentrons, whose technology automates wet lab work and which ran an automated Covid-19 testing lab for New York City, claims such tasks employ roughly 4 million workers worldwide. CEO Jon Brennan-Badal said the need for this work has grown rapidly as technology like gene sequencing has gone from rare to commonplace, requiring extensive productivity.

“It makes a lot more sense to make a scientist 10 times more productive as opposed to trying to create 10 times more scientists,” he said.

Opentrons’ new Flex system, which can move faster and do more complex work at a lower cost, reduces the fundamental cost of this tech from hundreds of thousands of dollars for machines and maintenance to tens of thousands of dollars. Brennan-Badal said this means startups can reduce their space needs, meaning less space, lower rental costs and a better chance of being able to locate near urban centers.

New York-based biotech firm Neochromosome, which focuses on genome-scale biological engineering, DNA synthesis and cell and protein engineering, is a subsidiary of Opentrons and uses its tech in the lab. Co-founder and CEO Leslie Mitchell said the Opentrons machines have helped the firm grow “exponentially, rather than linearly.” Going back to a lab environment lacking these technological tools would require more space.

“You’re going to need another person for every process you’re running, and the corresponding space associated with that person, versus some kind of robotic instrument,” Mitchell said. “Automation and software can speed up some processes 10 or even 100 times.”

Mitchell said Neochromosome started in a traditional incubator space, which offered the nascent startup access to tools and tech it wouldn’t have been able to afford on its own. But going forward, she sees incubator spaces that bring on this tech and hire automation engineers to operate it as a big selling point and benefit to new firms.

“Leveraging automation means you’re going to have lower square footage, potentially, and better unit economics overall,” Mitchell said.

Once firms begin to utilize automation at an early stage, that would suggest they will follow through with it throughout their life cycle, Mitchell added, and make similar investments in tech and real estate going forward.