|

Listen to this article |

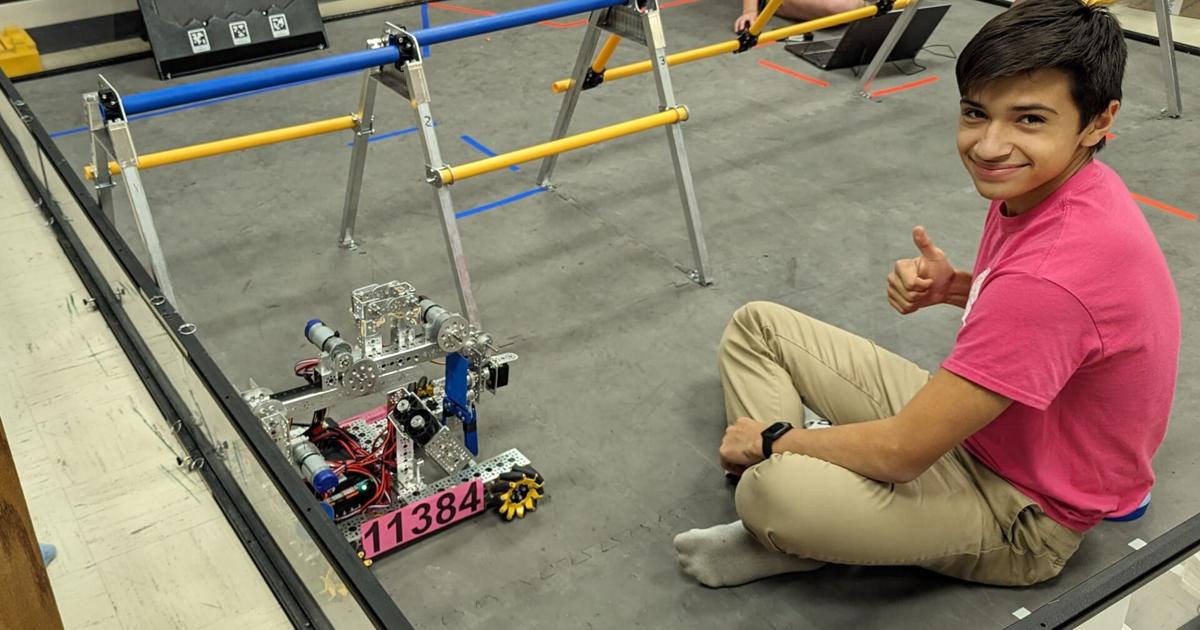

A Serve Robotics robot making a delivery. | Source: Serve Robotics

Serve Robotics, Inc., a leading autonomous sidewalk delivery company, today announced raising an aggregate of $30 million in financing, bringing the Company’s total funds raised to over $56 million.

Concurrent with the raise of new capital and conversion of existing convertible notes, Serve also completed a reverse merger with Patricia Acquisition Corp., a public Delaware corporation, whereby Serve became a wholly owned subsidiary of Patricia. Following the transaction, Patricia changed its name to Serve Robotics, Inc. and will continue the historic business of Serve.

The financing was led by existing investors, including Uber, NVIDIA (NASDAQ: NVDA), and Wavemaker Partners, with participation from new investors Mark Tompkins and Republic Deal Room. The transaction was sponsored by Montrose Capital Partners. Network 1 Financial Securities (as consulted by Intuitive Venture Partners) and Aegis Capital Corp served as co-placement agents.

Uber Vice President of Delivery and Head of Americas, Sarfraz Maredia has joined the Company’s board, effective July 31, 2023.

This financing enables Serve to enter new markets across the United States and further advance its industry-leading, AI-powered mobility platform. The company will also begin scaling up its robotic fleet to meet massive and rapidly-increasing customer demand for last-mile automation, including fulfilling its commercial agreement to deploy up to 2,000 robots with Uber Eats.

“We’re thrilled that our core strategic partners Uber and NVIDIA continue to back Serve as we work to bring sustainable, autonomous delivery to every doorstep in the next five years,” Dr. Ali Kashani, Co-founder and CEO of Serve, said. “Serve’s delivery volume has grown over 30% month-over-month on average for the past 18 months. Becoming a public company provides broader access to capital, supporting our continued growth as we ramp up our partnership with the world’s largest food delivery platform and expand other enterprise partnerships.”

The securities issued in the acquisition and sold in the private placement have not been registered under the Securities Act of 1933, as amended, and may not be resold absent registration under, or exemption from registration under, such Act.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.