|

Listen to this article |

Editor’s Note: Georg Stieler will be discussing the state of the Chinese robotics market during RoboBusiness 2023, which takes place Oct. 18-19 in Santa Clara, Calif. His talk, “Robotics in China,” takes place from 2:45-3:30 on Oct. 18 and will provide insights into the latest developments in robotics in China and what can be expected from there in the future. Register for RoboBusiness.

The situation in robotics and automation in China has never been as exciting as today. Last year, over half of all industrial robots worldwide were sold in the country. In the first six months of 2023, the upward trend continued: According to our calculations, the number of industrial robots sold during this period was 144,288 units, an increase of 17.1% compared to the previous year.

The Chinese market is now setting essential trends in industrial automation. What initially emerged in the manufacture of electronic products is continuing in electric cars, batteries, and photovoltaics. Since the country is leading in these areas, local companies benefit from corresponding economies of scale and learning effects.

Primary growth drivers

While the peak in commissioning new production capacities for electric cars has passed, projects in this area are still responsible for most robot sales. The most important sales segment in the years before 2022, the manufacture of electronic products, is suffering from restrained consumer demand domestically and the relocation of large capacities to Southeast Asia. This year’s primary growth drivers are robots in manufacturing solar panels and battery cells – applications that do not exist or only exist to a limited extent in Europe and the U.S. Market observers expect that the production capacity for solar panels will more than double from 380 GW at the beginning of 2022 to 750-800 GW by the end of this year. Storage facilities near wind or solar parks are establishing themselves as an additional sales market for battery cells.

In recent years, domestic manufacturers have increasingly penetrated areas previously reserved for foreign robot manufacturers. For example, last year, the leading domestic manufacturer of multi-axis industrial robots, Estun, sold over 17,000 robots in China, fewer than Fanuc and KUKA, but already more than ABB and Yaskawa. In the SCARA area, Inovance has massively taken market share from Epson and Yamaha. Significant reasons for the success of Chinese newcomers were delivery delays from international market leaders and the ability to quickly adapt to new market trends and develop scalable solutions for growth fields.

The great importance that the Chinese government attaches to broad STEM education is bearing fruit. Compared to Europe, more specialists are available on the developer and system integrator sides. Together with the local supply chain that has emerged in recent years, this enables shorter product cycles and drastically cheaper costs for machine vision, industrial robots, and collaborative robots.

Leading foreign companies are also increasingly relying on the local supply chain. KUKA opened the second expansion stage of the new factory in Shunde at the end of May. The plant is the largest robot manufacturing site in southern China. FANUC completed the expansion stage of its Shanghai plant in July. It is the most prominent site for the company outside of Japan.

Effects of weak Chinese economy

The trend that Chinese manufacturers strive abroad due to the brutal price competition continues. Cobot manufacturers JAKA, Dobot, and Aubo each plan to go public. JAKA wants to raise 750 million RMB in this way. A good part of this will be invested in international expansion. To hedge against increasing geopolitical risks, Chinese component manufacturers are building production sites in Southeast Asia, Europe, and North America. For example, Leaderdrive, one of the leading domestic servo and robot gear manufacturers, invests in capacity in Mexico.

Credit: Stieler Database

However, even robotics cannot escape the current weakness of the Chinese economy. According to our surveys, there were 95 financing transactions in the robotics sector in the first six months of the current year, with a total volume of 8.655 billion RMB. Most of this went into drones, machine vision, and medical robots, followed by investments in key components and multi-axis robots. The total amount is 33% below the same period last year and fits into a generally declining trend in venture capital transactions. Across all industries, these fell by 42% in Asia in the H1 2023. For robotics, China is thus behind the USA (1.48 billion USD) but significantly higher than the value we documented for corresponding financing activities in the EU (650 million USD).

Considering the prospects for robot sales, there are significant challenges ahead: Fanuc reported unprecedented inventory levels in China at the end of July. The company did not communicate detailed figures for the robot division, but the total orders of the group in the country fell by 42% compared to the previous year. According to Kenji Yamaguchi, President and CEO, the company does not expect a normalization of order intakes before 2024, possibly even later. The numbers for other heavyweights in the industry in China went in the same direction: Yaskawa’s orders in China fell group-wide by 27% in the second quarter, and ABB’s in the robot segment by 37%. Leaderdrive’s sales fell by 44% in the first six months of the current year.

Based on the economic data from August, this may not yet represent the lowest point. The adjustment process is likely to be difficult and could present existential challenges for many less efficient companies.

Since we began our operations in China, we have observed similar developments in other industries. For example, a consolidation process began in the construction machinery industry after the boom from 2007-2012. Leading Chinese companies like SANY have emerged stronger from this and now have their costs and processes under control. They can handle demand fluctuations well and have also developed into serious competitors for established European and American companies on the global market.

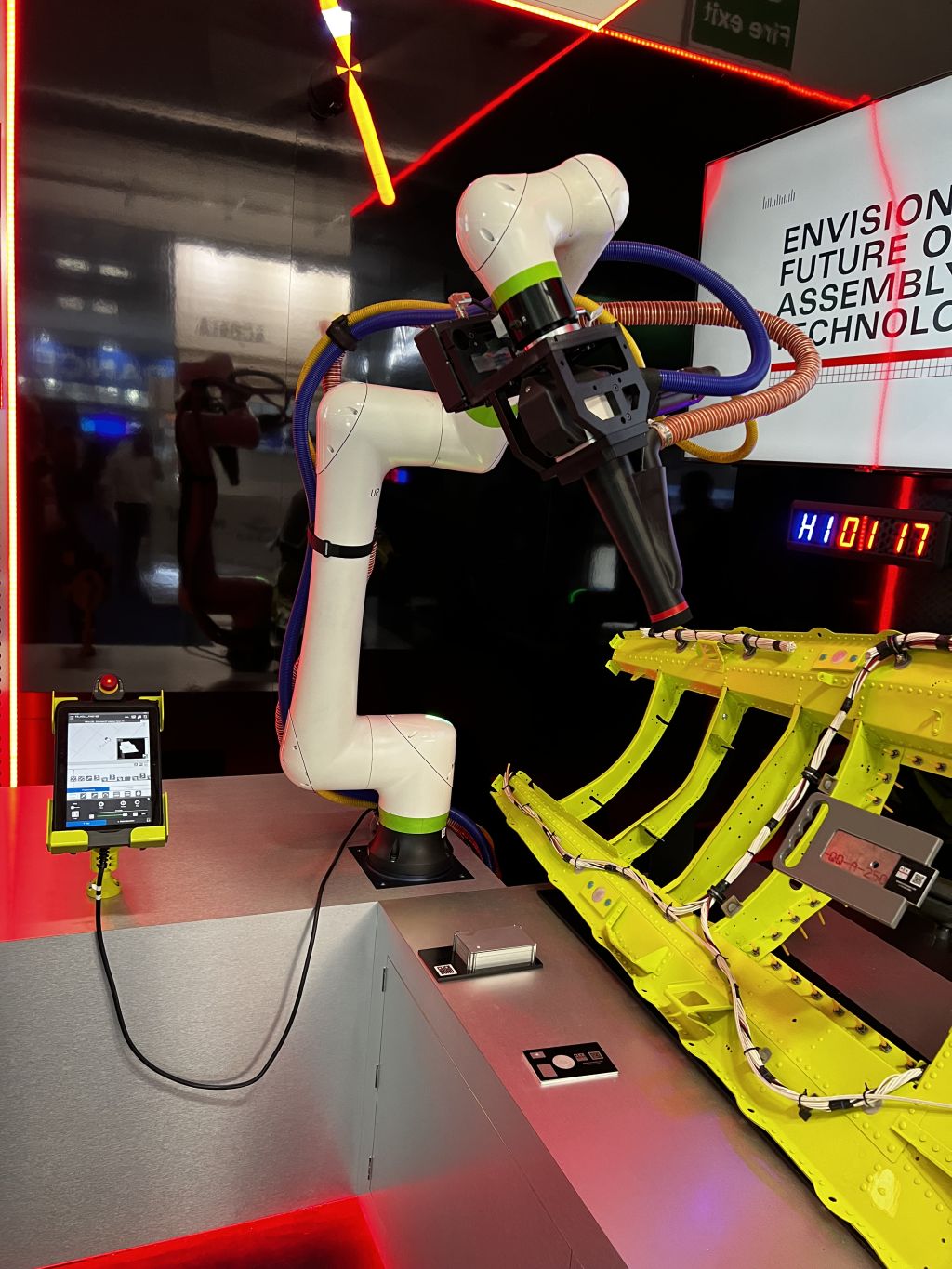

Robots in the production of solar cells and modules at Jinko Solar.

A bright future remains

In robotics, we expect a similar development. China will remain the largest market for robotics and automation products for the foreseeable future. We have already mentioned the strengths in major sales markets such as electric cars, batteries, and photovoltaics. The country now has a powerful supply chain for most key robotics components. The demographic challenges require the use of more robots.

A strong robot industry is an integral part of the modernization efforts of the Chinese government, and leading companies will continue to enjoy corresponding support. In August, the Beijing city government set up a related fund to be equipped with 10 billion RMB. In the medium term, more efficient AI will significantly expand the range of applications. Huawei founded a robotics subsidiary in June for this purpose, outfitted with 870 million RMB in registered capital.

Despite geopolitical tensions, we are receiving inquiries from European companies in the robotics sector on how to use the Chinese supply chain for themselves – for the local market and other regions. Depending on the product, the local ecosystem’s cost advantages, flexibility, and speed are too attractive.

About the Author

About the Author

Georg Stieler founded the Shanghai branch of Stieler Technology & Marketing Consulting in 2011. He has since implemented over 40 market entry and expansion projects in China with his local team, primarily for foreign companies in robotics, sensors, control technology, and software. This has given him extensive expertise in the Chinese automation industry, and he is now considered one of the leading experts in this field. He is also involved with young technology companies and helps them gain a foothold in the Asian and European markets.